Americans are almost unique in still having to file home country taxes from overseas. While this requirement has been US law since the Civil War, the interconnectedness of today’s global banking and tax systems have only recently allowed the IRS enforce it. They can even revoke expats’ US passports if they believe that they owe […]

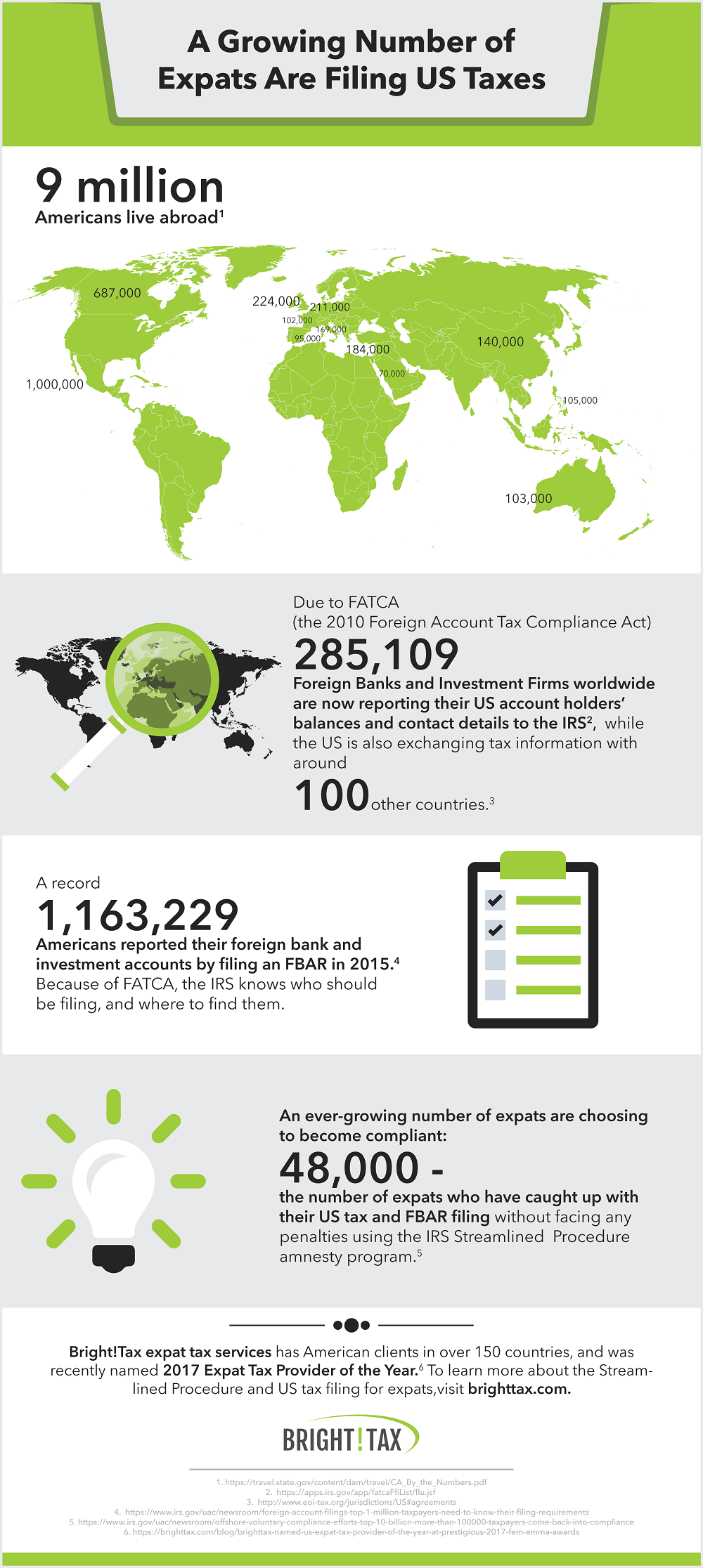

A Growing Number of Expats are Filing US Taxes

09/28/2017