Are you fostering a (not-so-secret) love affair with travel? Have you considered taking this relationship to the next level by finding a permanent or semi-permanent home overseas? You and everyone else, apparently!

The data is not shy in painting a clear picture – a record number of Americans are considering a move abroad. Between May and Nov 2020, International Living saw a traffic surge of 1676% on “How to Move Out of the US”. Separately, a national survey conducted by Wise found that 35% of people living in the US would consider moving abroad.

With the post-pandemic, remote-friendly world inching toward a new “normal,” it’s now easier than ever to begin turning search inquiries into action. Once abroad, many American expats report finding a better quality of life and a cheaper cost of living, too.

Still need a touch of added support? Bright!Tax has your back. Let this article act as a roadmap for your plans of *officially* becoming an American expat.

An obvious (but necessary) first step… Do your research

Knowledge is power is cliché for a reason. A move abroad requires meticulous preparation, so let’s say it one more time louder for the people in the back – research, research, and research some more!

Perhaps deciding where you want to live is a given. If this is you, feel free to skip this section.

For our friends with a more ~fluid~ plan of attack, first try narrowing your search to a general region. From there, zero in closer, identifying two or three countries that feel like a good fit.

Allow me to get meta for a just a moment… How does one even define a “good fit?”

Taking an honest look in the mirror to understand your needs and preferences will guide you to your “expat nirvana.” Whether you’re a journaler, meditator (or none of the above), dedicate some time with yourself to consider the following questions for your own benefit:

- What is your budget?

- What kind of healthcare do you need?

- Are you prepared to learn a new language?

- How easy is it to secure a residence visa?

- Will you rent or buy a home?

- Is there a large expat community, or will you need to acclimate to local culture right away?

- Do you prefer different seasons or warm weather year-round?

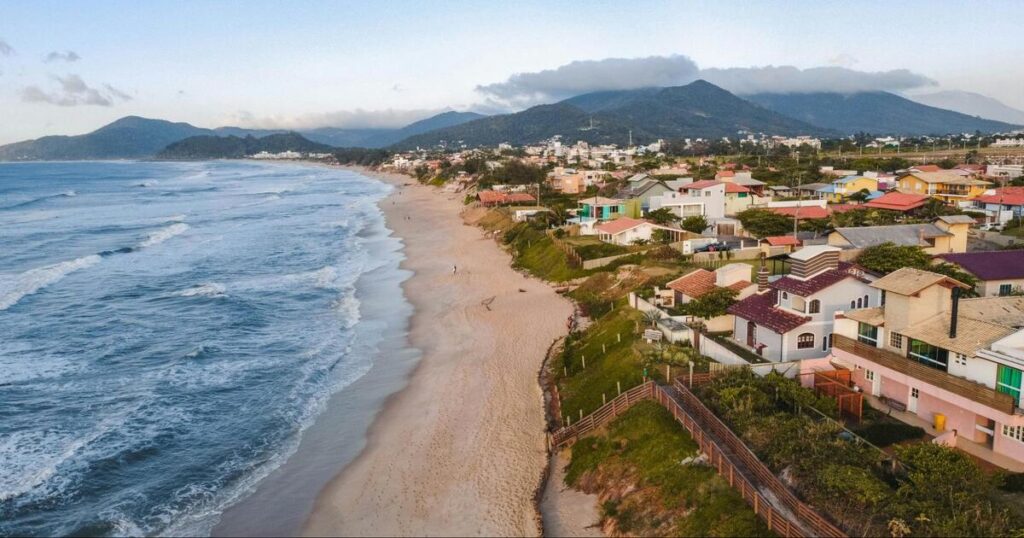

- How do you like to spend your time? Do you prefer laying on the beach, or do you crave a thriving metropolis?

- You get the gist.

As you continue researching, here are some additional relevant blog posts (read: shameless self-promo).

Scouting trips (An extra excuse to travel… you’re welcome!)

Battling commitment issues in narrowing down your search? It’s *prudent* to plan a few dry runs. Scoping out your potential host country is smart, but it’s also a fun data point in your search. A true win, win.

A “soft launch” of your new home abroad will allow you to explore different neighborhoods and get a feel for the people, the culture, and the daily cost of living.

Pro tip – if you’re able, go more than once and experiment with different times of the year. Then you’re able to get a feel for the seasons and explore multiple areas to see what suits you best.

*Cough cough* less exciting… Consider the health insurance

The topic of health insurance can be dry, yes. But let me (attempt to) captivate you with some good news. Depending on your destination, access to quality healthcare can be a fraction of your current spend in the US.

Though common, this isn’t always the case, so listen up. One of the most important steps on your journey to becoming an American expat is procuring adequate international health insurance. You know the drill – do your due diligence with online reviews, comparing options with a fine-tooth comb.

Taking a bulleted approach for some final considerations. Let’s make closing out this section as painless as possible, yes?

- Global healthcare plans may exclude the US. Plan accordingly if you’re traveling back to the States on occasion.

- Calling all retirees: ensure your plan has lifelong coverage. A handful have a ceiling at the age of 75 or 80.

Lights off, no one’s home! Selling or renting your US residence.

Have you considered how you might take advantage of your US home while you’re away?

It goes without saying (but we’ll say it anyway)… Selling your US home when you move abroad can be a game-changer in reducing debt. Goodbye, pesky mortgages. Hello, opportunity to purchase a property in your new host country (cc: the next section of this article).

Bonus points: if your home meets the IRS “ownership and use test,” you may be eligible for gains exclusions. Translation, you may be able to reduce or eliminate taxable income from the sale of your home.

Renting your home in the US is another interesting option. We love a savvy opportunity to *diversify* revenue streams. Not only can this provide peace of mind, but it may open up your capacity to explore other business (and recreational) ventures abroad. It’s all about the balance, yes?

Navigating international real estate waters (aka buying a home abroad)

A plot twist, if you will… Some countries restrict non-citizens from purchasing property. GASP. With some light, acrobatic hoop-jumping, you may be able to find a workaround, though:

- Some countries allow you to obtain special residence permits. Be prepared to fill out several forms and offer multiple forms of ID!

- Feeling especially #aggressive? Registering directly with a government agency may be best for you! Each country’s rules are different. Do your research prior.

The extra effort required to own property may be worth it in planning your move abroad. Let me elaborate. There are over 20 countries where property investment offers an easier path to citizenship. (Not surprisingly…?) the bigger the investment, the easier it is to become a citizen.

Our recommendation – speak to a few reputable real estate agents and brokers in your new host country. A native & experienced partner will navigate you through international real estate waters with worthwhile expertise.

The way to stay. Securing your residency visa.

Often the process can be started while you’re still in the US by getting in touch with the local embassies of your desired host country.

Many countries have dedicated retirement visas and programs. Others even have visas aimed at attracting digital nomads! Most temporary residency visas are accessible provided you meet certain monthly income thresholds, while others stipulate you have your own private health insurance.

In most cases, you can renew your temporary visa and then convert into a permanent resident. Net – acquiring a visa can be the first step to citizenship.

Work the network. Engage in online expat groups.

Fluffy, but true – settling into friendships makes your move abroad that much more rewarding. Tapping into American expatriate online communities can be hugely beneficial!

Get to know the lay of the land by proactively forging social connections before you even arrive.

Let Bright!Tax *brighten* your US tax filing process. (See what we did there?)

After moving abroad, you are still required to file a US tax return every year.

The IRS expects yearly reporting of your worldwide income, and you’re also beholden to tax laws in your new home country. Taking advantage of credits and exclusions is the ultimate win. (Hello, Foreign Earned Income Exclusion and Foreign Tax Credit – we love you!). Without these tactics, you risk double taxation.

It may also be worth formally cutting ties with your US state to avoid filing a state tax return. This likely includes relinquishing your driver’s license and removing your name from any property or financial accounts in the state. Most will relieve you of residency status after six months with proof of your new home abroad. Certain states make it more difficult, and you will need to show proof you won’t return as a resident.

The punch line… let our team of American expat tax specialists assist in planning your move abroad! Bright!Tax expertly informs you of federal and state tax obligations and helps minimize the US taxes you will pay (most often zero) year-over-year.